GoPro (GPRO) is set to report Q2 earnings tonight after the close with a conference call to follow at 5pm ET. GPRO reported Q1 earnings at 4:15pm.

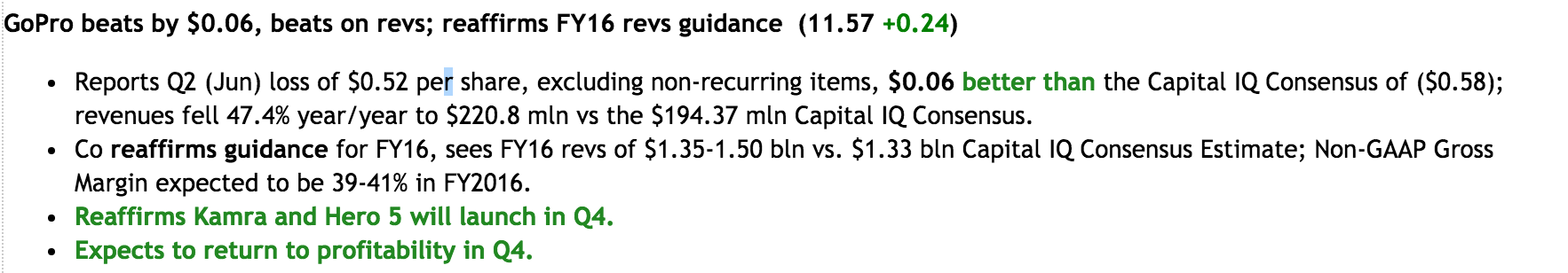

Current Capital IQ consensus stands at Loss of $0.58 per share on Revenue of $194.3 mln.

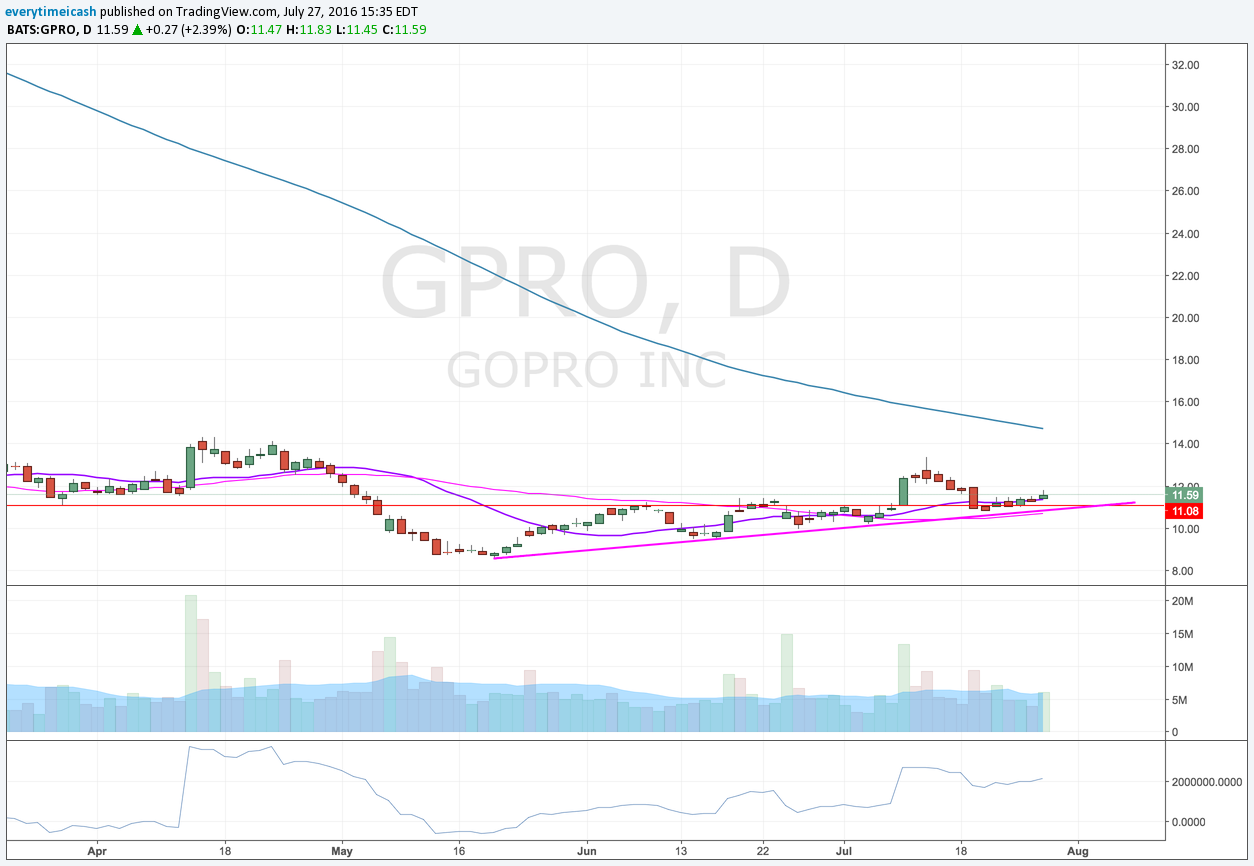

GPRO has two important items facing it: 1) working down inventory and 2) launching new products. That is why the stock was hit hard on the Q1 call when GPRO disappointed investors and told them the launch of the Karma drone and Hero5 would be delayed until the holidays.

Guidance

- In Q1 co reaffirms guidance for FY16, seeing FY16 revs in the range of $1.35-1.50 bln vs. $1.36 bln Capital IQ Consensus Estimate. This was important given the product launch delays.

Q1 Recap

- GPRO reported Q1 (Mar) loss of $0.63 per share, excluding non-recurring items, $0.04 worse than the Capital IQ Consensus of ($0.59); revenues fell 49.5% year/year to $183.5 mln vs the $169.55 mln Capital IQ Consensus.

- Non-GAAP Gross Margin 33% (Guidance 35-37%), Co noted that this should mark the low end for 2016.

- GoPro said it has no further financial exposure remaining from purchase commitments and inventory related to end-of-life HERO camera line.

- According to NPD, GoPro's first quarter combined digital camera/camcorder unit share in the U.S. increased 150 basis points year-over-year to 20.9%.

Click here to listen to my podcast and learn about my theory on the similarities between relationships and the stock market.