Gilead Sciences is scheduled to report 2Q16 earnings on July 25 after the market closes.

Consensus calls for 2Q16 EPS of $3.01 (vs. $3.15 last year) with revenue down 4.9% to $7.8 bln.

- The stock trades at just 7.3x FY16 EPS estimates as investors demand growth (similar story to that of AAPL). Sales and earnings are expected to fall ~4% this year. Earnings are expected to grow ~2% next year with sales down 1% as the co aggressively buys back shares.

- Investors want the co to acquire its next blockbuster drug. Last month, the CFO said it has the balance sheet to acquire a large oncology asset. Gilead bought back $15 bln shares in FY15 and commenced a $12 bln share buyback in FY16, purchasing $8 bln worth of shares in 1Q16.

FY16 Guidance

The co reiterated FY16 guidance below Consensus on April 28 when they reported 1Q16 earnings. Capital IQ Consensus calls for a 2.5% decrease in FY16 rev to ~$31.8 bln, compared to $32.6 bln in FY15.

- Net product sales: $30-31 bln

- Adj Product gross margin: 88-90%

- Adj R & D expenses: $3.2-3.5 bln

- Adj SG & A expenses: $3.3-3.6 bln

- Adj Effective tax rate: 18%-20%

1Q16 Recap

- The co reported 1Q16 earnings of $3.03/share, $0.10 worse than the Capital IQ Consensus of $3.13, rev rose 2.6% y/y to $7.79 bln vs the $8.07 bln Consensus.

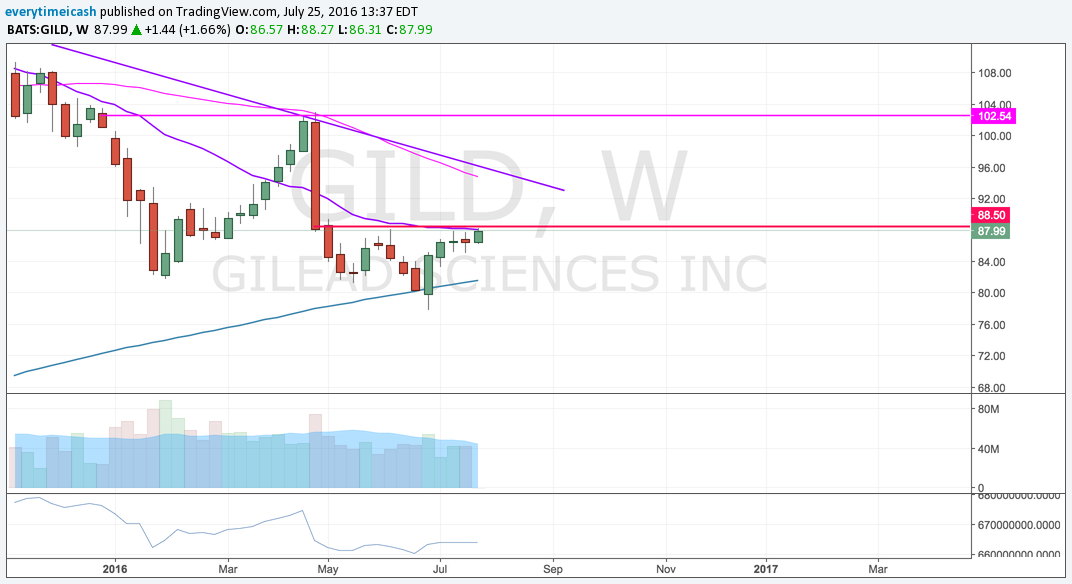

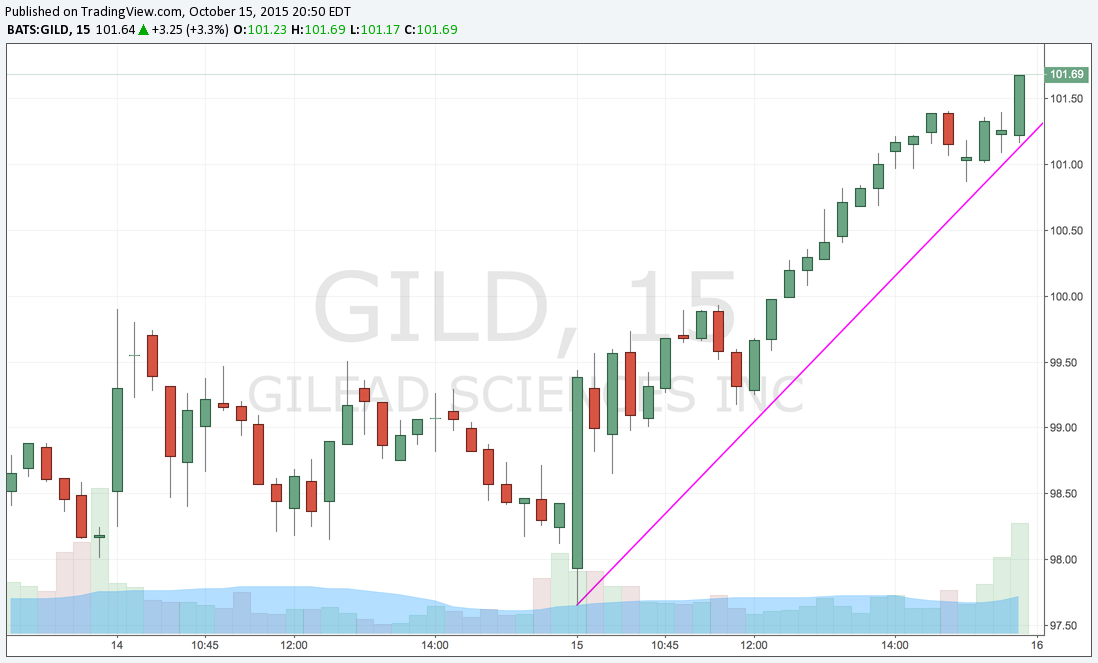

Technical Analysis

Technically, GILD has been an under-performer since its last earnings report in April had its selling back down to its early Jan/Feb lows around the $82 area. Buyers will want to clear this 87/88 resistance and lift price back into the late-April bearish gap between the 92/96 zone.

The 200-day moving averages are also in play around 91/92. Sellers will simply want to keep the pressure on by dropping the stock back towards this year's lows in the 78/82 range.

Implied Vol

Based on GILD options, the current implied volatility stands at ~ 29%, which is 14% higher than historical volatility (over the past 30 days). Based on the GILD Weekly Jul29 $86.5 straddle, the options market is currently pricing in a move of ~5% in either direction by weekly expiration (Friday).

Click here to listen to my podcast and learn more about my theory on relationships and the stock market.