“The fruits of your success will be in direct ratio to the honesty and sincerity of your own effort in keeping your own records, doing your own thinking, and reaching your own conclusions.”

If the Wall St. narrative runs its course, something definitely has to give with AAPL. The issue, which has traded poorly since making an all time continues to do so. If you have not yet, you should start to consider what your threshold tolerance for pain should be.

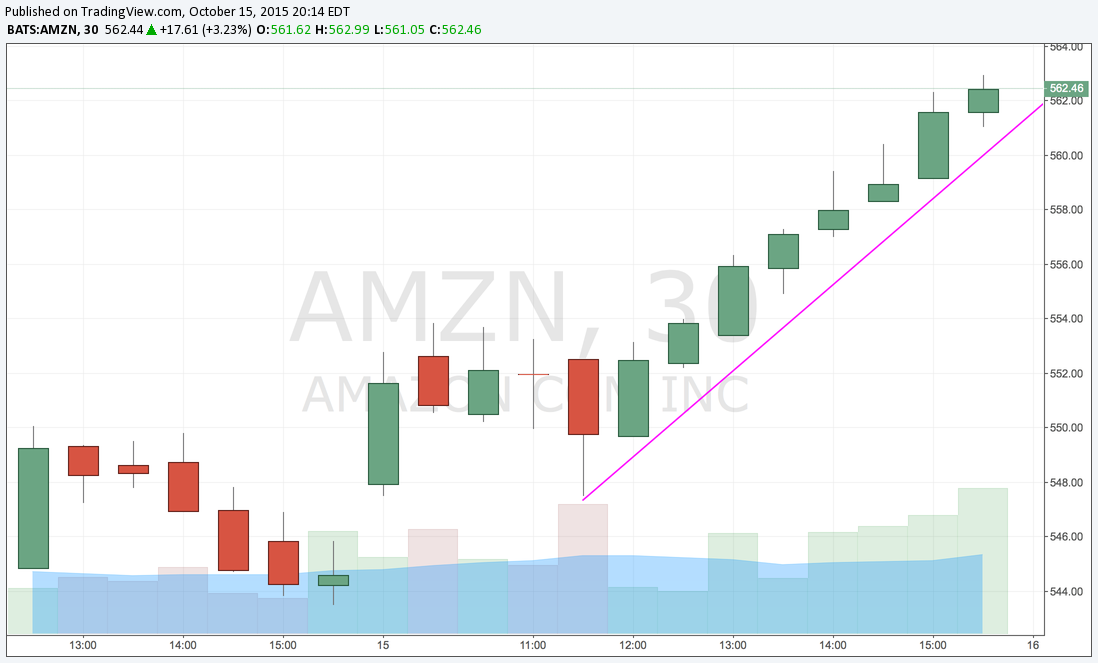

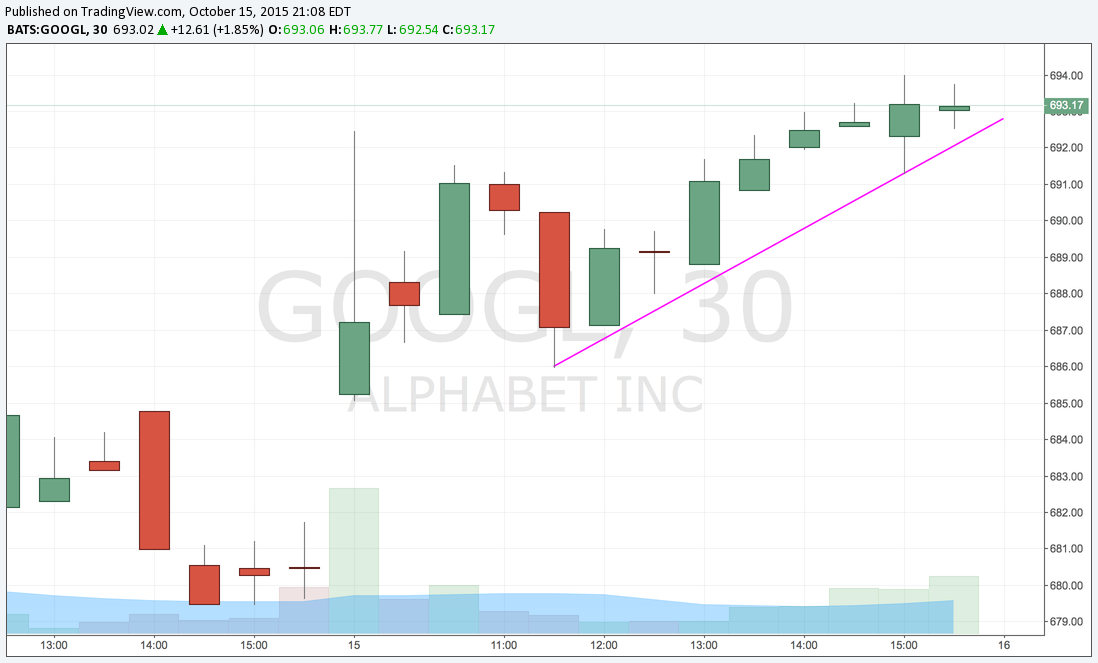

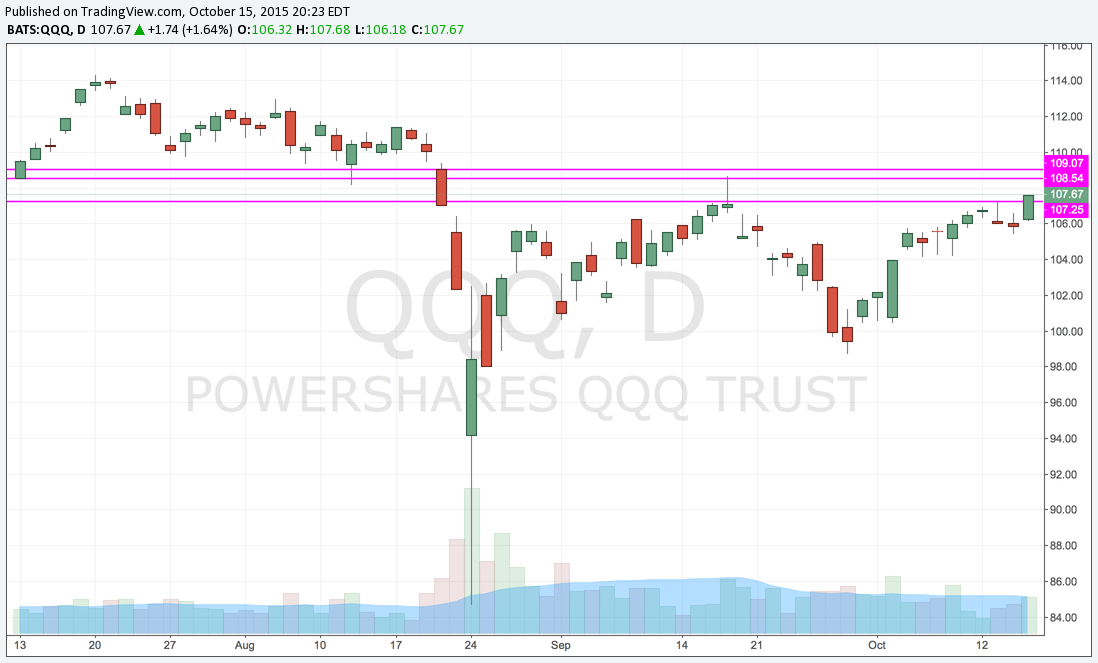

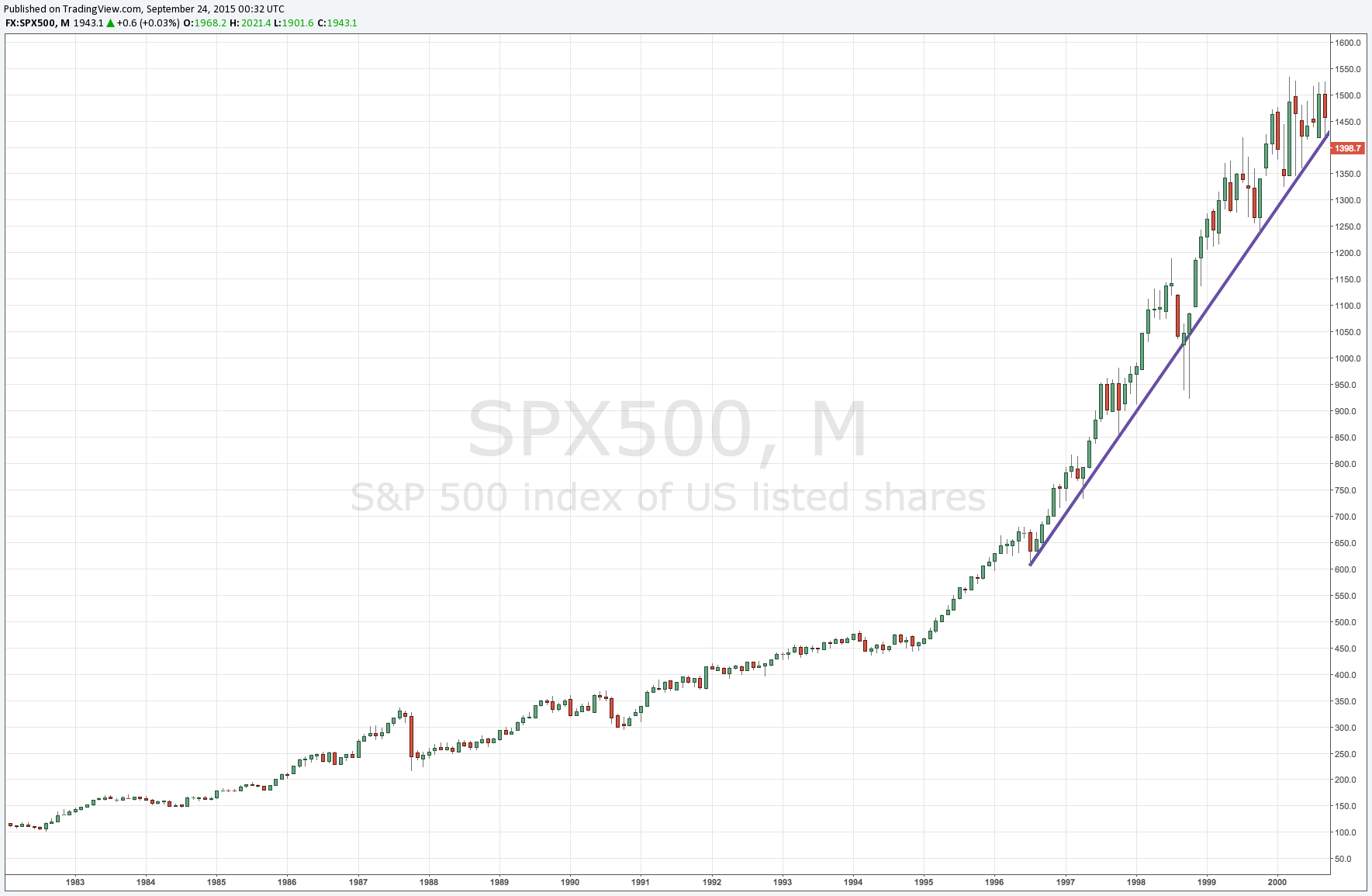

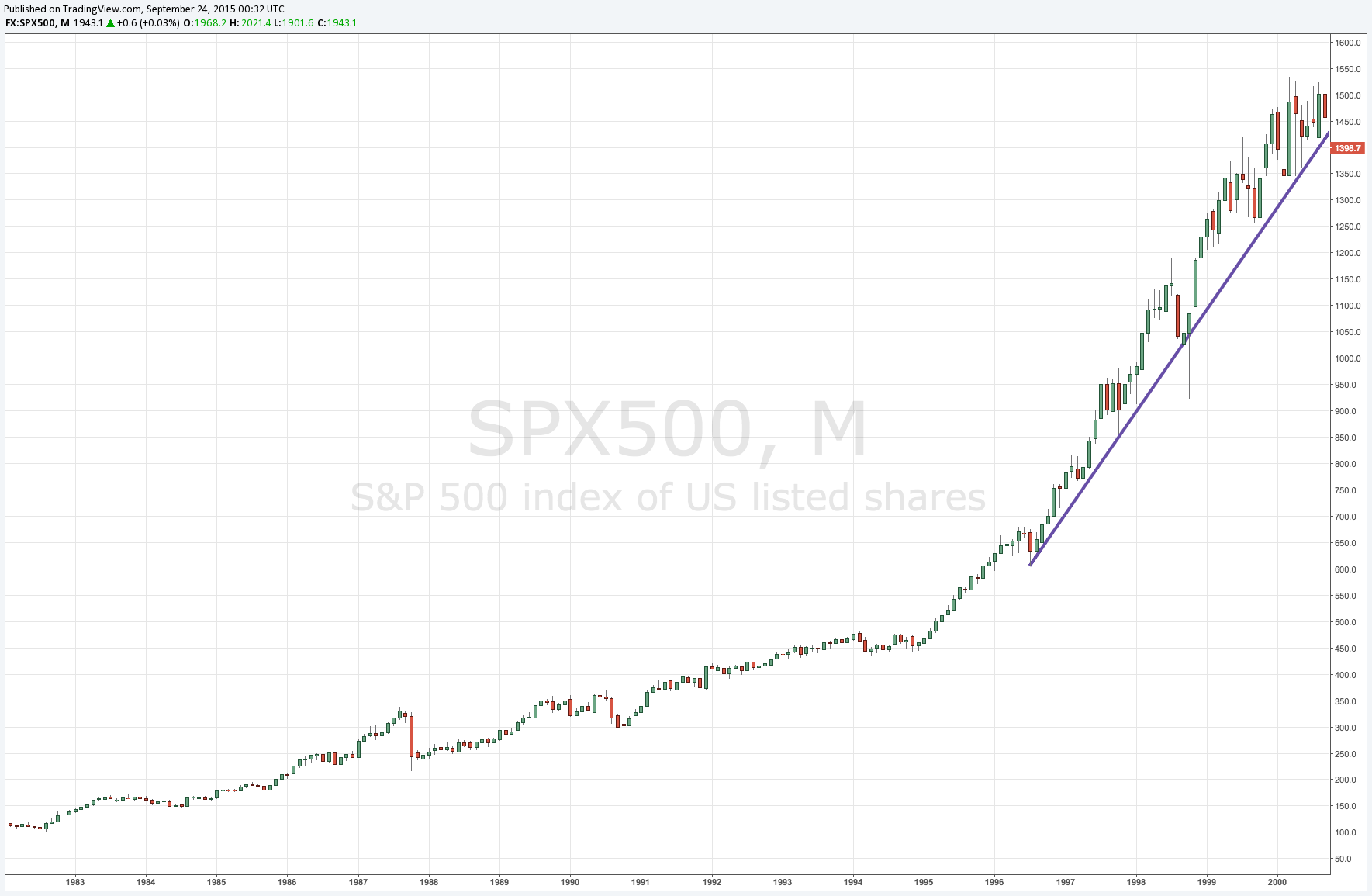

What was once a market leader, AAPL has certainly underperformed its peers this year. With stocks like AMZN NFLX and GOOGL all up substantially YTD it is only fair to wonder what is happening with AAPL (the stock, not the company). Before I dive in a little deeper I want to stress that I am a big fan of the company and believe that they are the most soundly run company that I've ever encountered. I liken Apple as the A student in the class. Eventually, the teacher gets accustomed to that student's stellar results and starts to only make commentary on his/her "poor" (A-) performance. The opposite is also true. There will always be students that are B/C students and when they start to perform up to the B/A level the teacher will be impressed more so than when the A student continues to make his/her marks. Let's focus on this first.

As humans, we're psychologically wired a certain way. Specifically, we like to believe that we are the purveyors of information and that we actually know more than our peers. Ironically however, it takes those same peers for us to get anywhere typically. That's why shit stocks like TWTR continue to find fools as they continue their landslide lower. In order for a market to be made, you need liquidity. In order for liquidity to exist, you need people on opposite sides.

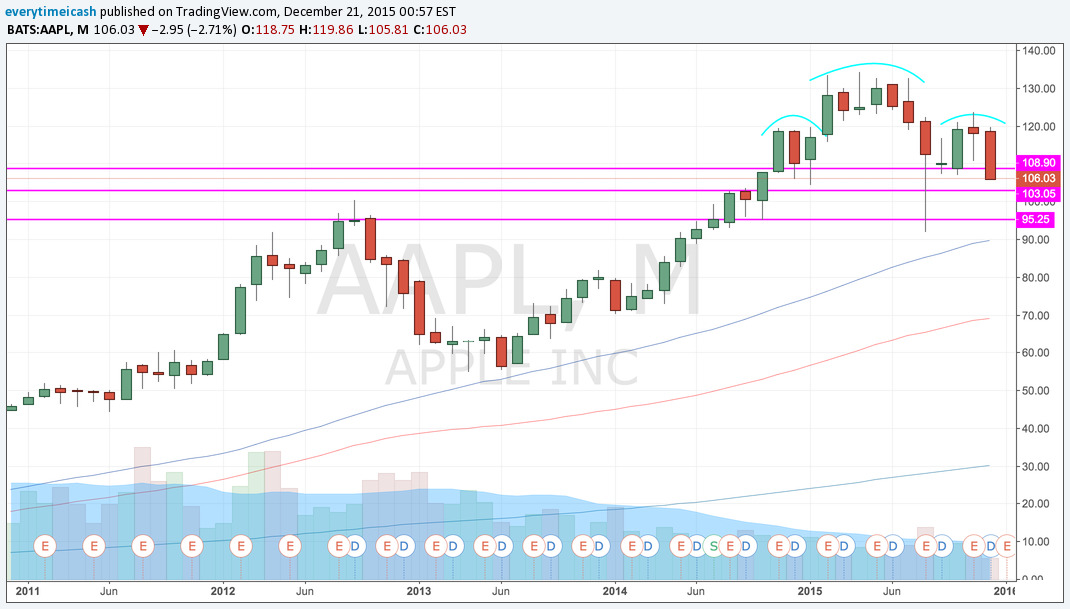

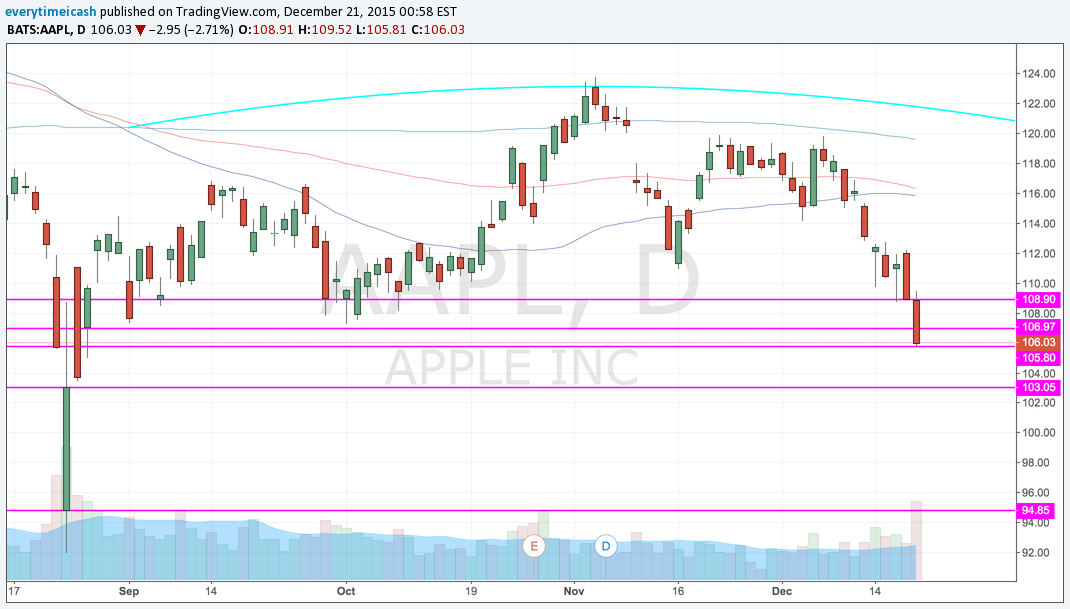

It is very important to distinguish between Apple the company, and AAPL the stock. As I said above, the company is likely the best one we've ever seen and will ever see in our lifetime. Currently however, the stock is not. As highlighted a multiple times and most recently a week ago, the stock is currently and has been trading poorly. It does not matter what time frame you use on a chart, it is tough to find viable support in the issue. That said, that's not the biggest problem the stock may face. I use the word may because this company has been founded on innovation and can turn the corner at any point and regain their innovative ways. We can all speculate what we believe is in their pipeline, or what cutting a particular supplier may do, but at the end of the day we simply do not know.

GETTING "OVER"

Aside from poor performance and relative weakness to its peers, AAPL has another hurdle it may have to overcome. Up until now, the stock is still endeared in the eyes of Wall St. analysts. With 47 Buy ratings, 7 Holds, and 1 Sell, the stock is still heralded. Though this works in the favor of the company currently, it may end up "taking a bite" out of the stock in the future (if things precipitate to the downside).

Let me put that statement in basic terms for you. Currently, basically everyone and their fucking brother is positive on AAPL, and the stock still can't seem to perform. What happens when people who have been bullish all of a sudden get tired of the bull case and switch their tune? If the stock is not performing by then, it will likely start to really crumble.

Click the "Join Now" button below to sign up for private content and real time actionable alerts.

Another past positive and potential clusterfuck for them is the ownership stake by Carl Icahn. Upon announcement of the stock purchase, the stock rallied, and rallied hard to eventual all time highs. Icahn indicated that this purchase was again a "no brainer" like his NFLX transaction. Though this may be the case, the stock's performance has not been that way. So it will be interesting to see where he goes with this trade moving forward given quickly rising poor market sentiment.

THE SKINNY

At this point many speculate that part of the problem with how AAPL has been behaving/performing is in part due to their potential that this will in fact be the first holiday quarter in which the company does not see iPhone sales increases. Put another way, this will be the first time (allegedly) where the company sees a slowdown in iPhone sales year over year (COMPS).

That said, the stock is still cheap. Trading at <10x EPS. At this point it really depends on what type of investor/trader you are. If you are of the speculative variety and look for quick hitters, this is probably not the stock for you. If you are looking for value and for potential long term growth, this could soon provide you with the "no brainer" opportunity many see/saw in the stock. In my eyes, the stock is currently a "no touch" until it proves the 105/103 support zones are for real or clears 122.

As always, if you found any of this useful please share. Cheers!

For real time actionable trade alerts and private site content.