Fossil beats by $0.17, beats on revs; guides Q1 EPS below consensus, revs in-line; guides FY16 EPS in-line, revs above consensus

- Reports Q4 (Dec) GAAP earnings of $1.46 per share, $0.17 better than the Consensus of $1.29; revenues fell 6.8% year/year to $992.5 mln vs the $923.86 mln Consensus. During the fourth quarter of fiscal 2015, the translation impact of a stronger U.S. dollar decreased the Company's reported net sales by $55.6 million, operating income by $38.7 million and diluted earnings per share by $0.28.

- Global retail comps for the fourth quarter of fiscal 2015 increased 1% compared to the fourth quarter of fiscal 2014. A solid comparable sales increase in Europe was partially offset by a modest decline in the Americas and a flat comp in Asia. A comparable sales increase in leathers and watches was partially offset by a decline in jewelry.

- Gross margin decreased 380 basis points to 53.0%.

Co issues guidance for Q1, sees GAAP EPS of $0.05-0.20 vs. $0.41 Capital IQ Consensus Estimate; sees Q1 revs (10)-(7%) to ~$652-674 mln vs. $661.41 mln Capital IQ Consensus Estimate.

Co issues guidance for FY16, sees GAAP EPS of $2.80-3.60 vs. $3.18 Capital IQ Consensus Estimate; sees FY16 revs (3.5%) to +1% ~$3.12-3.26 bln vs. $3.04 bln Capital IQ Consensus Estimate.

This is an example of what happens when expectations are just so low and a company doesnt report nearly as bad as everyone is expecting. Looking at the numbers they aren't that great, but they are a beat. The aspect that is troubling to me however is the continued lowball guidance the company issues.

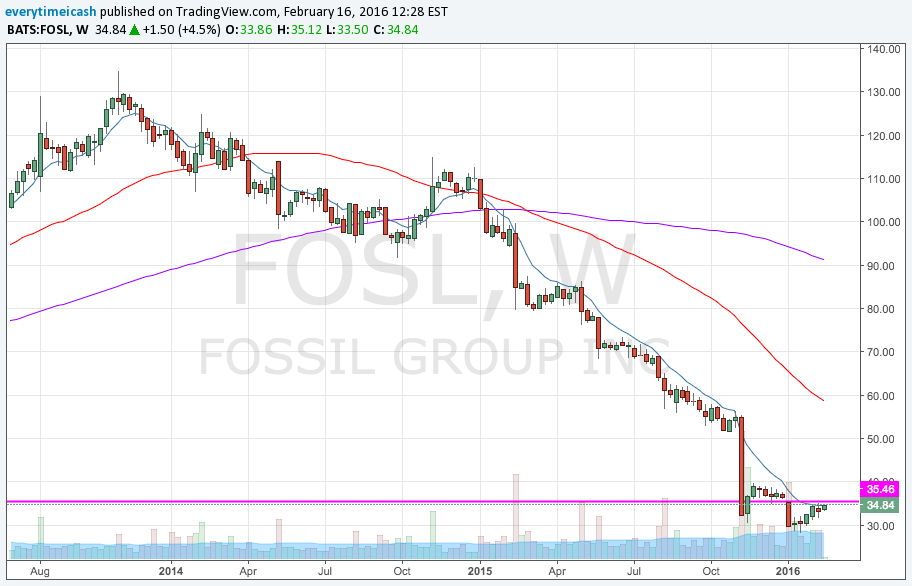

As you can see from the charts above, not much overhead resistance exists until we meet the MA's at ~50/share